Many clients come to me, sometimes even before retiring, asking me to help them give their homes to their children to “protect it from Medicaid.” They are the lucky ones who haven’t already done so through a friendly paralegal or attorney who did not ask important questions or give important advice.

There are some benefits and also a number of risks to giving away any real estate, but especially your home and especially if you do not keep a life use. I will discuss the practical and tax concerns of this in another article, but for the time being I would like to focus on one of the single biggest issues that folks are unaware of: if you have money you want to protect for yourself from Medicaid, owning a home can actually make it easier to do it!

You see, “money” is a dirty word for Medicaid: if you want help with your care, you have to be pretty much out of it (a healthy spouse can keep a bit, but not that much). But while you can’t have money, they will ignore your home, even a nice and pretty expensive one, so long as you or your spouse reside there. If you receive in-home care, an increasingly popular option, they don’t touch your house. If you go into your nursing home and your spouse remains at home, they don’t touch your house. You can even go into a nursing home for up to six months after Medicare Part A coverage expires, and Medicaid will give you an allowance to pay your mortgage, taxes, and insurance while you are away!

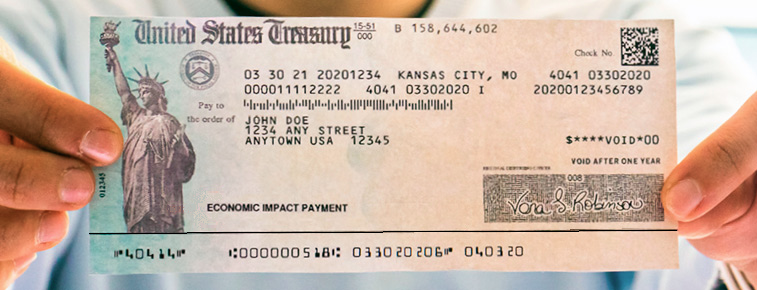

If you have money and need assistance with your care, Medicaid will ask you to spend that money (ideally on that care) before they’re willing to pay a penny. But if you also have a house, you can use the money to pay off your mortgage, make the house more accessible, upgrade the kitchen, add central air, or build an extension, and Medicaid will pay right away. You can also buy a house from not owning one at all to spend down that extra money, and save the cost of rent. Even more stunning, Medicaid’s definition of “your house” is much closer to “the plot your house is on and all of the land and structures you own that touch it.” There are actual recent examples of seniors who have used their savings on an adjacent plot of land, or have bought an apartment building and let their relatives occupy other units rent free. And the state HATES THIS. But they legally have to approve you for benefits.

While you can put money into your house, you can also take money out of it without being disqualified from benefits. So-called “reverse mortgages” often get a bad rap due to misunderstandings by consumers and also some bad practices that took place before the federal government began supervising and insuring the process. In reality, reverse mortgages are fair and useful vehicles in many circumstances, whether or not you have Medicaid. But if you do have Medicaid, the State of Connecticut offers you a bonus: if you take money out of the house through a reverse mortgage, they pretend you don’t have it, so long as you keep it in its own “segregated” bank account until you spend it.

So in summary: a man with $50,000.00, a house, and serious daily care needs have to pay for his care until only $1,600.00 of that money is left. But if the same man puts that money into home improvements, or a bigger house, or paying off a mortgage, he will be eligible right away. And if he borrows the same money right back out through a reverse mortgage, he won’t have to spend any of it on his care. Like the title says, it’s legal money-laundering.

To be clear, this is not a perfect solution. Nothing with Medicaid is. There are also caps, exceptions, and exclusions to many of the legal rules I have summarized in this article. At the very least, I hope by reading this you will understand that multiple considerations in protecting assets for your children as well as for your own use, and a conversation with a qualified elder law attorney is essential before making such a big decision so that you are fully informed of the different scenarios that could take place, and what these mean not just for your future wallet, but for your future care and quality of life.

Attorney Rosenberg practices throughout South-Central Connecticut. He can be reached at 203-871-3830 or by email at Scott@ScottRosenbergLaw.com.